Introduction

EDF’s Venture Capital Facility (VCF) exists to provide strategic equity investments in key and strategic companies and sectors aimed at promoting trade (cross border trade/Exports) and infrastructure development. This involves provision of capital to fund development stage of projects, expansions or buy-outs of existing ventures. The benefits of this facility include:

- Differentiated, broad and unique focus to fill the equity gap in intra-Malawian trade and export development/manufacturing value chain

- This has the benefit of increasing the share of equity instruments in the funding mix in the country.

- The ability to secure highly technical and financial expertise and capacity for the investees.

Eligible ventures

- Small and medium enterprises (SMEs); emerging corporates and mature businesses

- Growth, buy-out (in partnership with strategic investors).

Product Features

EDFs participation in venture capital may follow any of the forms such as equity and quasi equity instruments.

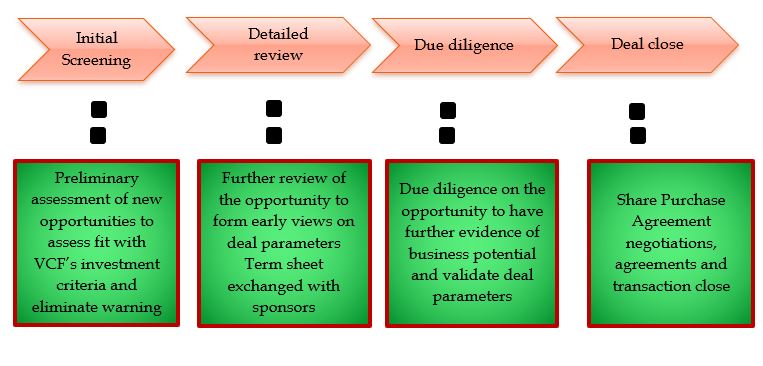

Investment Process

Eligible Intervention Beneficiaries

Amongst others this facility will support;

- Companies making the transition from import-substitution to export orientation;

- Companies moving up the export value chain, i.e. from raw commodity exporters to processed goods exporters;

- Traders with successful track-record who plan to go into export manufacturing

- Logistic and transport services that support trade;

- Trade enabling/carrying infrastructure;

- Tradable services.